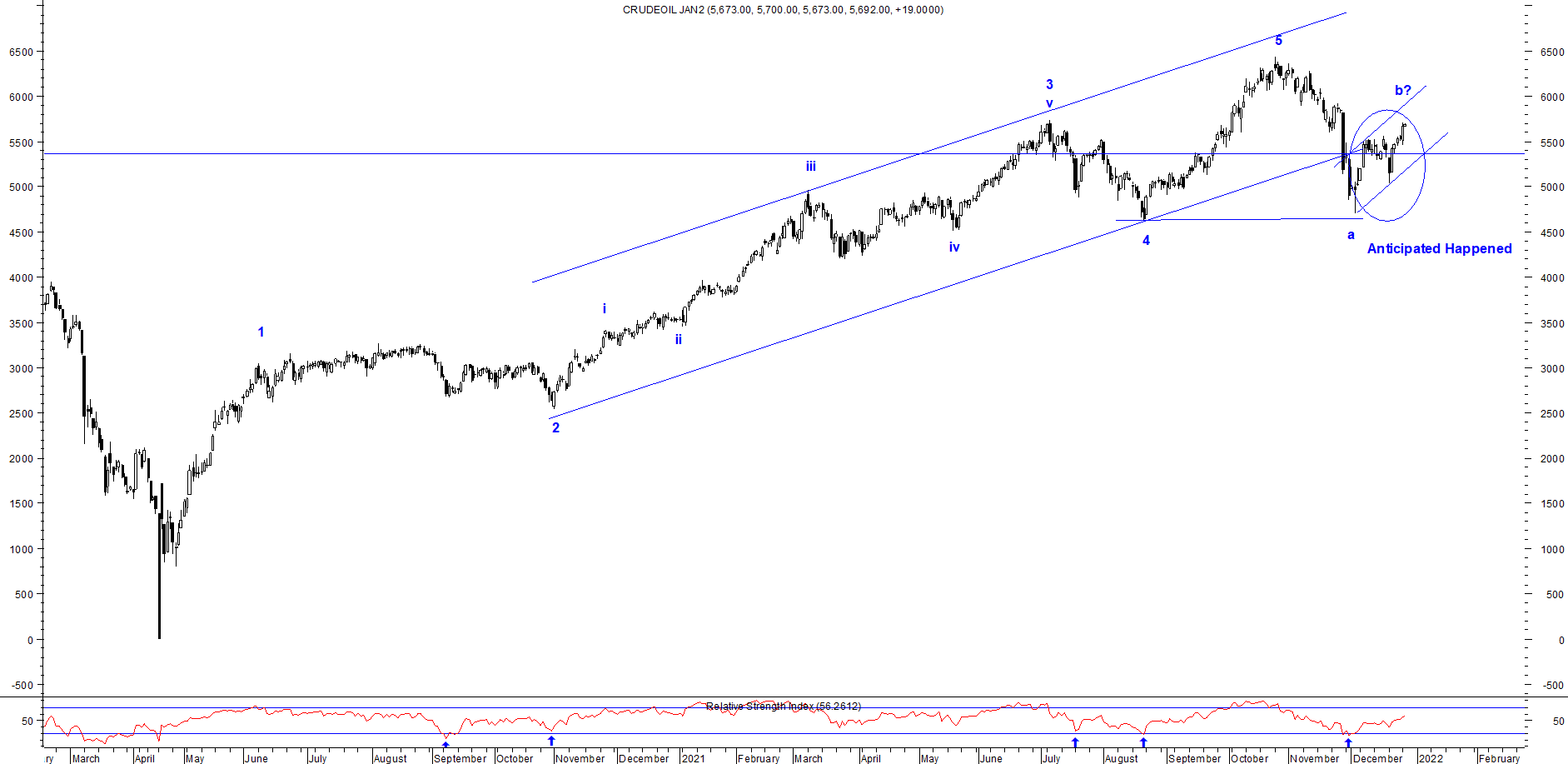

Nifty Anticipated Happened

Nifty 60 mins chart anticipated on 19th April 2022 Nifty 60 mins chart happened on 11th May 2022 In my previous update, I had mentioned, " Nifty can bounce from current levels near till 17200-17400 levels and then it will move back down towards 16200-16000 levels over short to medium term." Nifty bounced and reached the level of 17400 levels from the level of 16800 levels thereby achieving my mentioned level of 17200-17400 levels (highlighted in blue) and from there the index plunged below 16000 levels, thus achieving the levels below (highlighted in yellow) - Anticipated Happened To view my previous article on Nifty, click on the below link https://www.marketanalysiswithmeghmody.com/2022/04/nifty-anticipated-happened-and-elliott.html Prices are at crucial stage as it has arrived near very strong support but at the same time it is early to catch the reversal from here. I will be monitoring the move and update you timely.