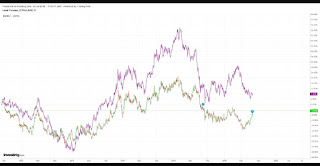

Lead and Zinc: Positive to negative correlation

Daily spread chart Lead and Zinc has been moving in sync but from few months the correlation has been negative as Lead is moving up but zinc is failing to show strength. This can also be interpreted as Zinc is possibly forming a basing formation and is on verge to reverse the trend so that to be in tandem with the other. In short, Lead is showing strength but zinc is not, the trend for zinc can change which will make a positive correlation going ahead.