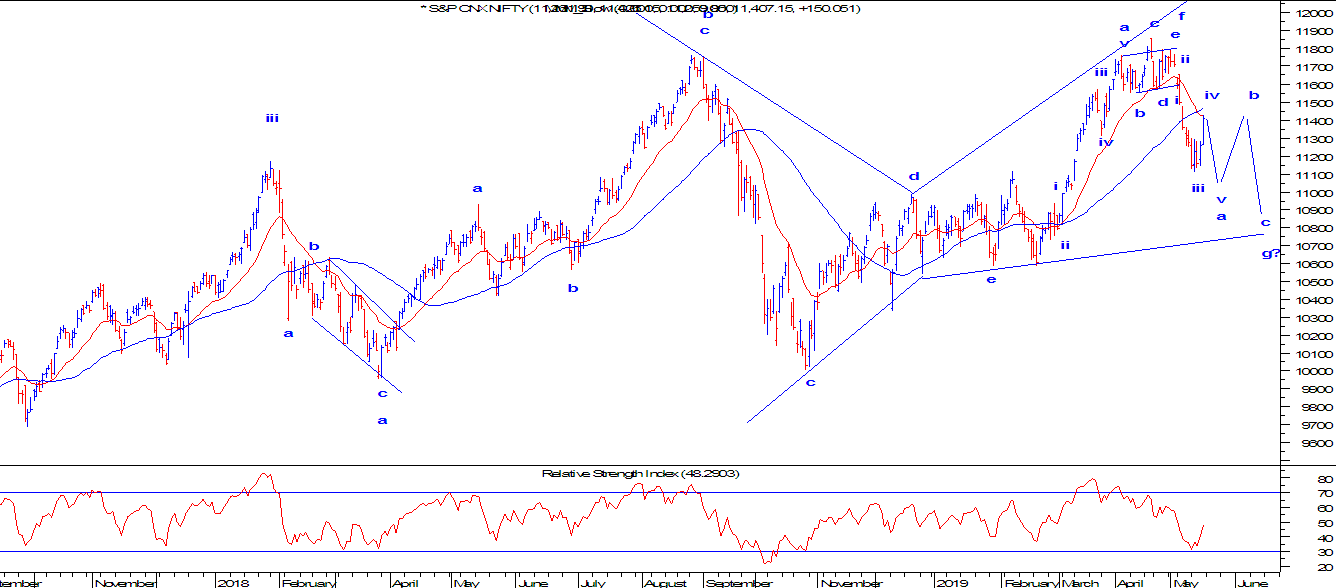

Nifty: Start of correction

Nifty Hourly chart In the above hourly chart, prices are moving in a falling black channel. Last week it faced the resistance of 11850 and reversed falling more than 100 points on Friday. This indicates that the short term trend is negative From wave perspective after completing five waves up, prices are moving in a complex correction (a-b-c-x-a-b-c). It recently completed wave x and has started falling in the form of wave a of second correction. This fall can drag prices lower till 11550 levels where the support of the gap is placed along with 20 weekly EMA. The summation is prices are negatively poised and is on the verge to fall near 11550 levels. The resistance is at 11850 levels, any move above this level will change the trend.