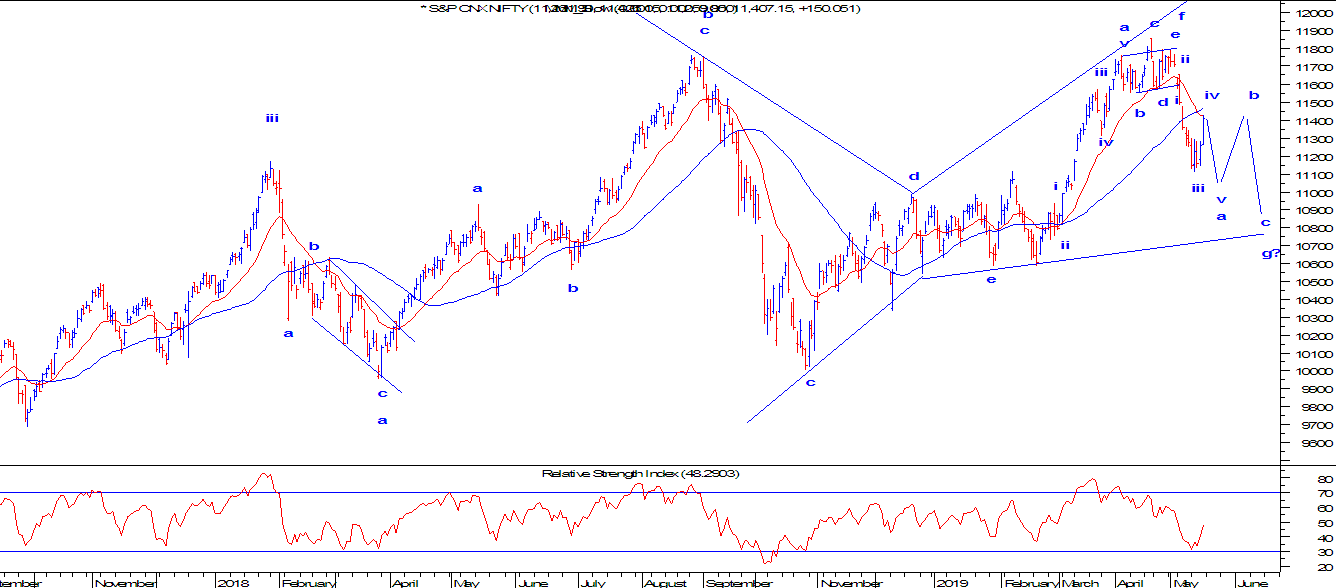

Nifty at one higher degree and forecasting through Neo wave

Nifty Daily Chart Last week I had written an article on Nifty that the selling will intensify ahead of election results. Nifty did made a new low and continued the downtrend. However, in the last two days of the week Nifty closed above 11400 levels. This article on Nifty will concentrate on one higher degree which moreover looks like a sideways pattern. The rage of this pattern is is of 11600 and 11100 on the downside. So it is better to go with an option strategy more likely of a Straddle, which is to buy call and put of same strike price and expiry. Call ATM Put 1096 11400 58 A bearish crossover is seen in Nifty. An impulse fall is still intact with wave iv on the brink to complete and wave v to start anytime soon. Also the bigger wave looks to be a bow and tie diametric in which last leg of diametric is ongoing. In this case wa