Nifty Bank Elliott Wave

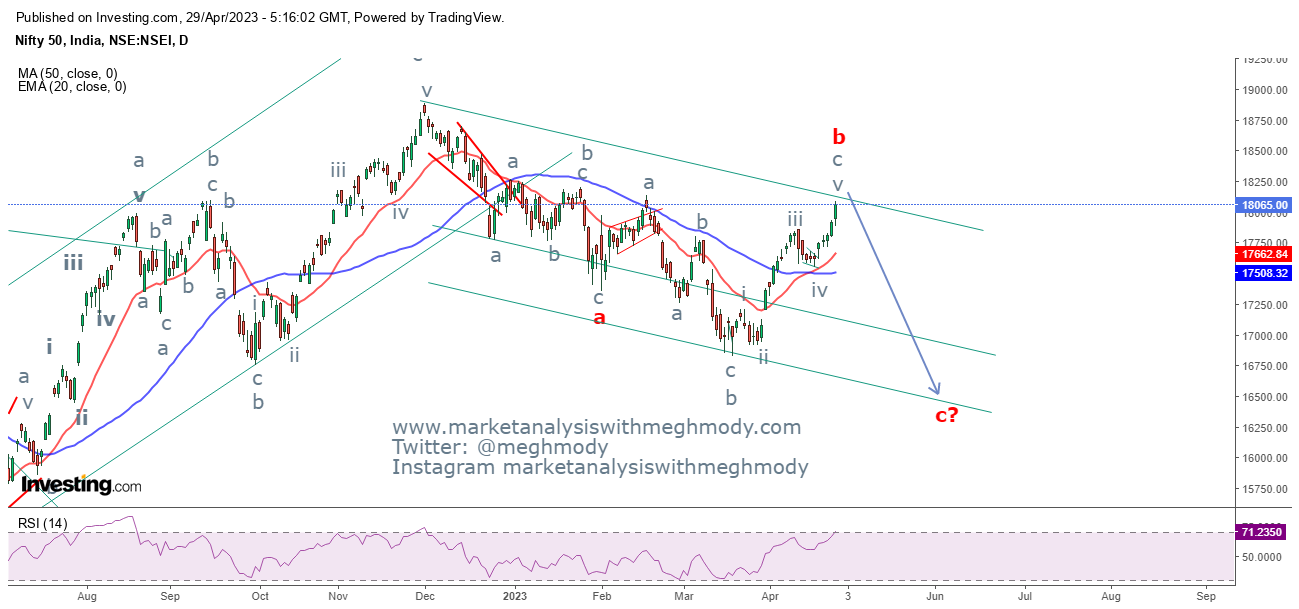

Nifty Bank daily chart Nifty Bank 2 hour chart Analysis As expected in Nifty Bank, prices crossed 42,350 levels and reached my mentioned level of 42,700 levels - Anticipated Happened From daily chart, the index is moving in a rising channel and it is moving precisely in this positive formation. As of now there is no reversal seen but most of the oscillators are in overbought and can possibly remain in overbought terrain going ahead while price continue to soar. The index has crossed 80% of the previous fall 44,150 -38,610 levels. and there is a possibility for the index to climb towards 100% also. As seen in the 2 hour chart, the index is taking support of 20 EMA (red) which is a sign to figure the potential support of the index. The moment it fluctuates to and fro it will give an indication of a top being placed. At current juncture there is no sign of this and so prices are expected to move higher from current levels. Wave theory suggests that prices are moving in wave B in whic...