Nifty Elliott Wave Forecast

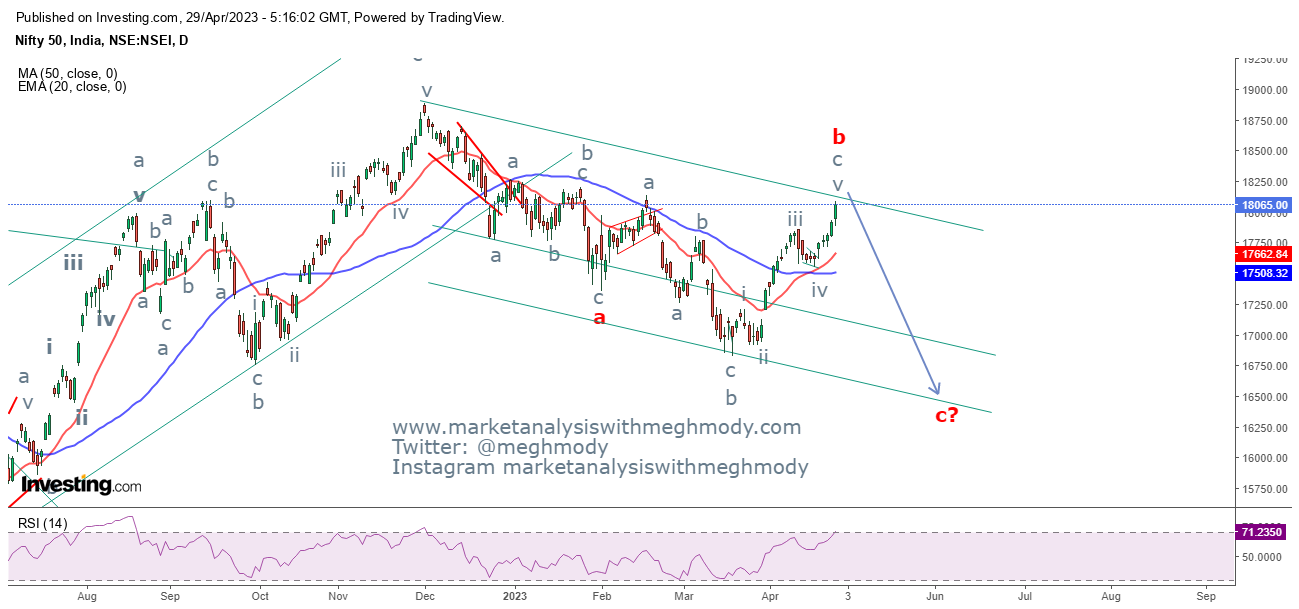

Nifty daily chart

Nifty 4 hour chart

Analysis

In my previous update, I had mentioned that Nifty can open positive possibilities once the level of 17660 is breached decisively which can soar index price towards 18,000-18,100 levels.

After breaking the above mentioned level the index made a high of 18,089 levels thereby achieving my mentioned range - Anticipated Happened.

As seen in the above daily chart, the index has moved past 18,000 levels with RSI in overbought terrain. Also it is arriving near to crucial resistance of 18,165 levels where the February high was made. All these factors pin point that Nifty can shown signs of reversal.

From 4 hour chart, prices are moving in a higher highs and higher lows but RSI is in extremely overbought terrain. Not only that lower time frames are well above 80 levels indicating there is not enough vacuum for the index to travel higher.

Elliott Wave theory suggests that, prices are moving in wave c of wave b which is the last leg. Also five waves up can be easily seen or counted. Wave b started from February and might end in the month of May start. This will then open wave c lower.

Note: This is just a possibility of my counting but looks with more conviction. One can wait for a reversal to come from the resistance zone of 18165-18200 and I will keep updating of the probability as it progresses.

The summation is one need to be cautiously positive for Nifty as it is arriving near to the resistance zone of 18,165-18200 levels. There can be 100-130 points rally but will be short lived. Any reversal from these levels will open negative possibilities going ahead.

Join my Telegram Channel : https://t.me/elliottician1

Join My Twitter handle : https://twitter.com/meghmody?

Comments