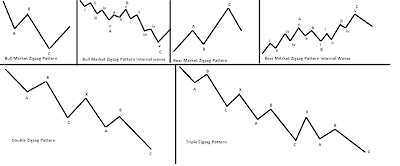

Identifying Zigzag Pattern

The big picture of Elliot wave is a five wave structure followed by 3 wave structure. In this educational article we have tried to show our readers how simple zigzag pattern looks and what internal structures does it have? A zigzag pattern in Bull market has a 3 wave structure (a-b-c) in downside, as soon as the third wave is complete it will start its next leg on upside. The internal waves of each three wave are (5-3-5) which will complete one zigzag pattern. A zigzag pattern in a Bear market has a 3 wave structure (a-b-c) but here it is on the upside. Once the third leg on the upside is over it will start moving lower. The internal waves of each three leg are (5-3-5) which completes one Bear market zigzag pattern. It is occasionally observed that Zigzags occur twice or thrice at succession. This happens when one zigzag pattern falls short of its target. In this case each zigzag is separated by one more wave, after completing that wave again zigzag pattern will start w