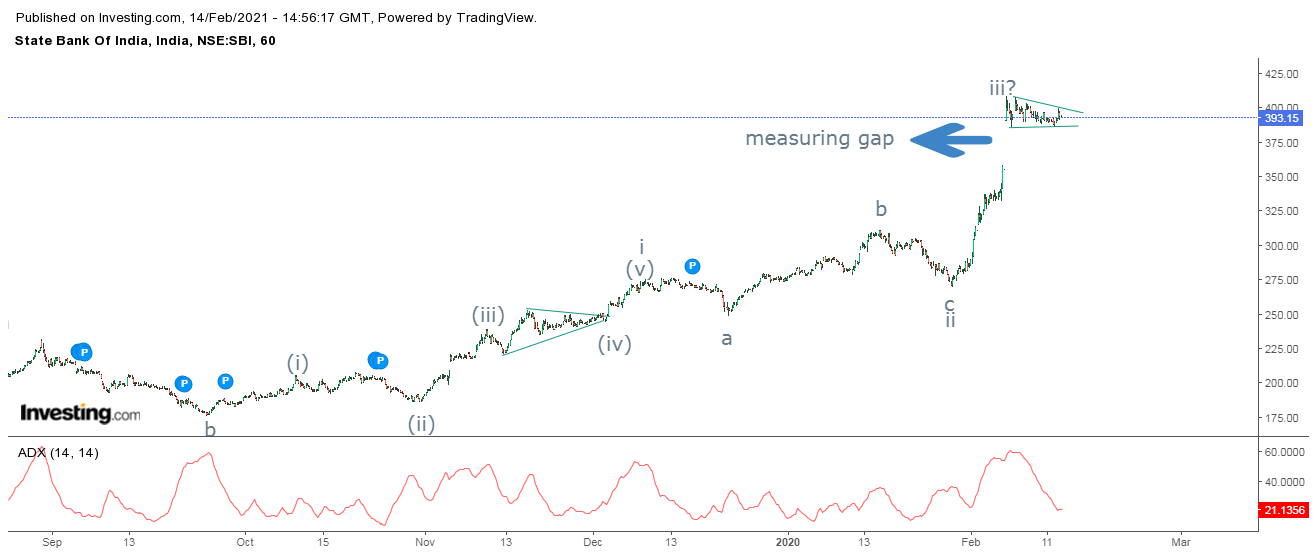

SBIN Anticipated Happened

SBIN hourly chart anticipated on 14th Feb 2021 SBIN hourly chart happened on 18th Feb 2021 In my previous update on SBIN dated 14th February, I had mentioned that, " SBIN is set to conquer 417-420 levels provided the level of 386 is intact on the downside. Any move below 386 will negate the triangle pattern, and it will open other corrective patterns."- Anticipated Happened. Prices marked a high of 429 levels, thereby achieving my mentioned level of 417-420 levels. Here is the link of my previous article of SBIN dated 14th Feb. Click on the link https://www.marketanalysiswithmeghmody.com/2021/02/sbin-elliott-wave-analysis.html It is difficult to place manual wave counts without knowing the theory. You can learn the theory along with practical applications of Wave Analysis. It will be a one month webinar and the details are mentioned below. Learn Technical Analysis in our 4 month course to help you to identify better trade setups. This course will be conducted every twice in