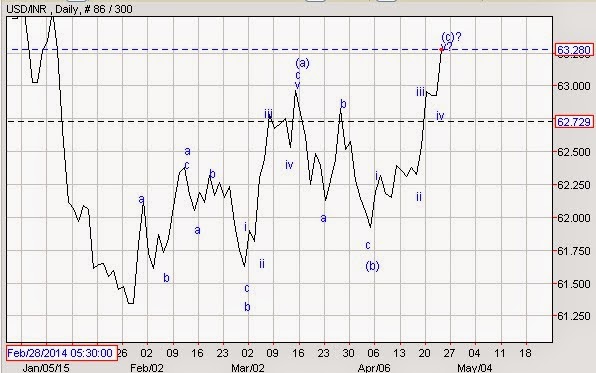

USDINR (3-3-5) Elliott Wave analysis

The pair moved up till 63.30 levels in today’s trading session, but it is important to see how wave counts are clearly visible on Daily charts. From the lows of February 2015, prices moved in a 3 wave structure and completed wave a of wave (a), followed by wave b at 61.50 of wave (a) and then wave c at 63.00 levels where it completed wave (a). Then it came down in a corrective fashion (a-b-c), where it completed wave (b). Currently it is moving up crossing the level of 63.00 levels in a 5 wave structure in which it is probably moving in a last wave i.e wave v of wave (c). Termination of this last leg of wave (c) will change the trend from positive to negative and can slip back down in near term. The next leg on the down side can be corrective or impulsive. It is imminent that prices will reverse and can test the level of 62.30-62.50 levels in coming month or so.