DJIA expected to test 18200?

Dow Jones Industrial Average is quoting at 18000 levels after no clue given by FED as when to hike the interest rate. In the recent minutes released last week, many policymakers thinks that June is an appropriate month to lift the interest rate, but the inflation is a concern. The delay has actually helped the global markets to outperform. It is always better to be one step ahead of major turnings for investors and traders to catch the trend.

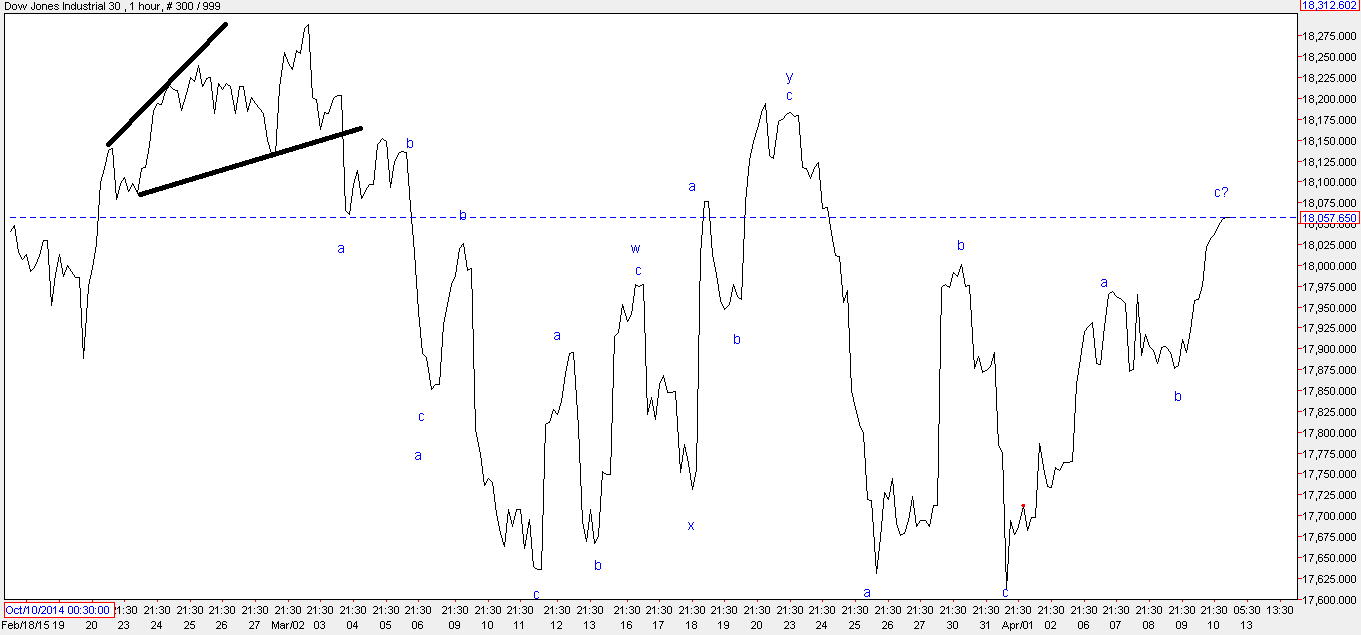

Advance technical analysis such as Elliott Wave can probably help to identify the reversal. From the chart it is clear that prices are moving in a complex pattern and it is advisable to stick to the basics as well. The index is protecting its previous lows and crossing its previous pivot highs. In this case there is a possibility for prices to move in a sideways direction in a range of 17800-18200. It is likely that prices can test its previous high placed at 18200, as current up move is in the form of corrective pattern (a-b-c). The c wave can reach near to its previous pivot high.

In short, DJIA may test the level of 18200 in near term as far as the level of 17800 is intact on downside.

DJIA hourly chart

Advance technical analysis such as Elliott Wave can probably help to identify the reversal. From the chart it is clear that prices are moving in a complex pattern and it is advisable to stick to the basics as well. The index is protecting its previous lows and crossing its previous pivot highs. In this case there is a possibility for prices to move in a sideways direction in a range of 17800-18200. It is likely that prices can test its previous high placed at 18200, as current up move is in the form of corrective pattern (a-b-c). The c wave can reach near to its previous pivot high.

In short, DJIA may test the level of 18200 in near term as far as the level of 17800 is intact on downside.

DJIA hourly chart

Comments