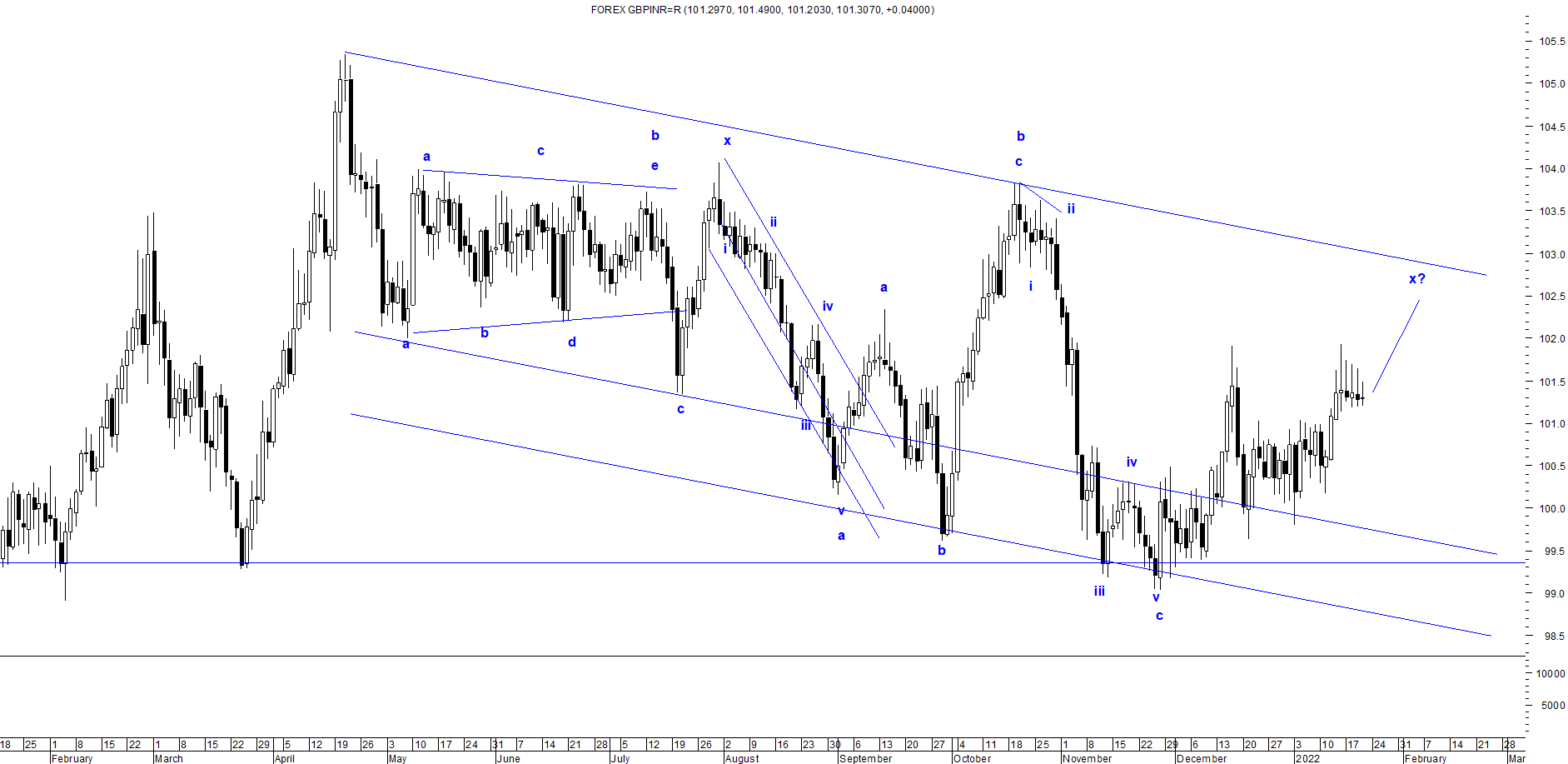

USDINR: NEO Wave Extracting Triangle in making?

USDINR spot daily chart As shown in the above daily chart, USDINR is been moving in a sideways direction mainly in the range of 77-73 levels in past two years. Currently prices are hovering near to the resistance of the upper range as mentioned above, there is high possibility that prices will dip from here to test the lower range. At present there is no change in trend, as the pair continue to move in a rising channel. However, there is a Neo Wave pattern in making which is a possible reversal pattern. After completing wave W at 72.25, prices moved higher in a complex correction pattern (w-x-y). In wave y there is a high possibility where Neo Wave Extracting Triangle is in making, which will complete wave X and then wave Y will eventually turn prices down towards 73-73.5 levels minimum, it can go down further as well. The summation is USDINR is all set to reverse and possibly hit the level of 73-73.5 levels over short term, only if it does not go above the 76.5 levels (spot).