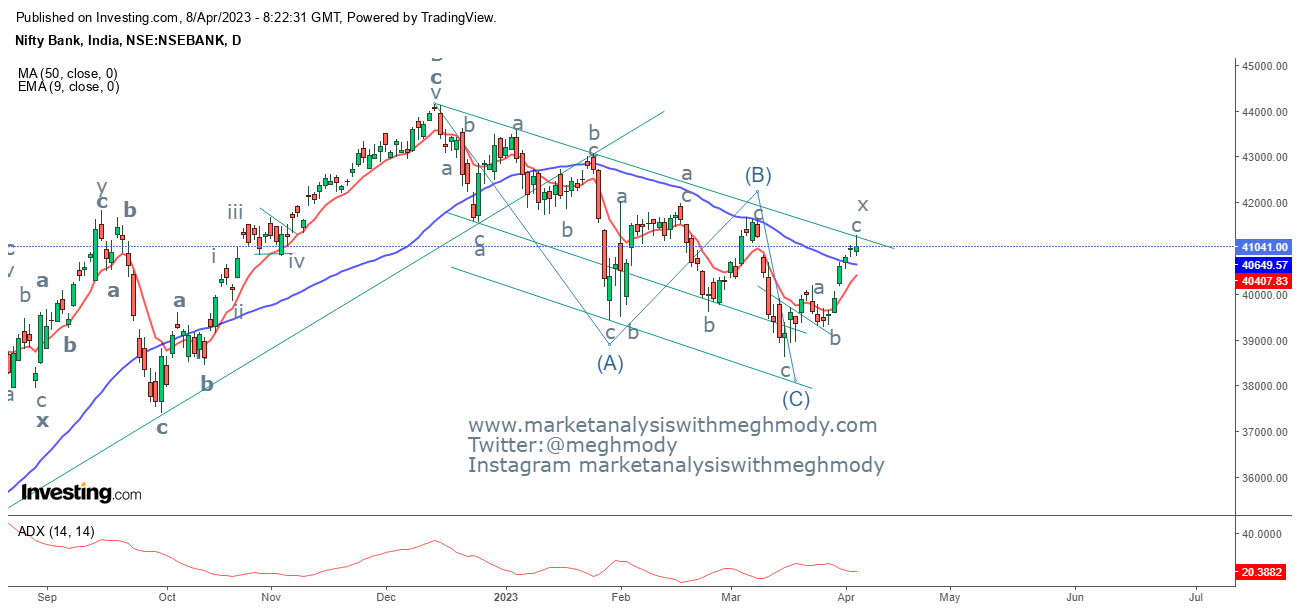

Nifty Bank Elliott Wave Analysis

Nifty Bank daily chart

Nifty Bank 2 hour chart anticipated on 3rd April 2023

Nifty Bank 2 hour hart happened on 6th April 2023

Analysis

As mentioned in my previous update, Nifty Bank is positively poised and can move higher towards 41200-41400 levels over short term.

Nifty Bank made a high of 41242 thereby achieving my level of 41200-41400 - Anticipated Happened

To view my previous update, click on the below mentioned link

https://www.marketanalysiswithmeghmody.com/2023/04/nifty-bank-elliott-wave-analysis.html

As shown in the above daily chart, the benchmark has arrived near to the resistance of the channel and has formed an advance bloc (candlestick pattern) near the resistance. There needs to be a confirmation which can only be obtained if there is a red / black candle on the following day. However, any move above 41350 will open further positive possibilities for the index.

From 2 hour chart, prices are moving higher with the moving averages supporting the index in a positive way. A hindrance needs to be crossed for a trending move to emerge. At the same time any move below 40650 will change the direction from positive to negative.

Wave theory suggests, the index is moving in double correction (a-b-c-x-a-b-c) where it has completed wave x and wave a will start on the lower side. The other possibility is (a-b-c) is over and new leg on the upside will start.

The summation is Nifty Bank needs confirmation above 41350 to resume its upward journey. However, any move below 40650 will give a signal of reversal.

Comments