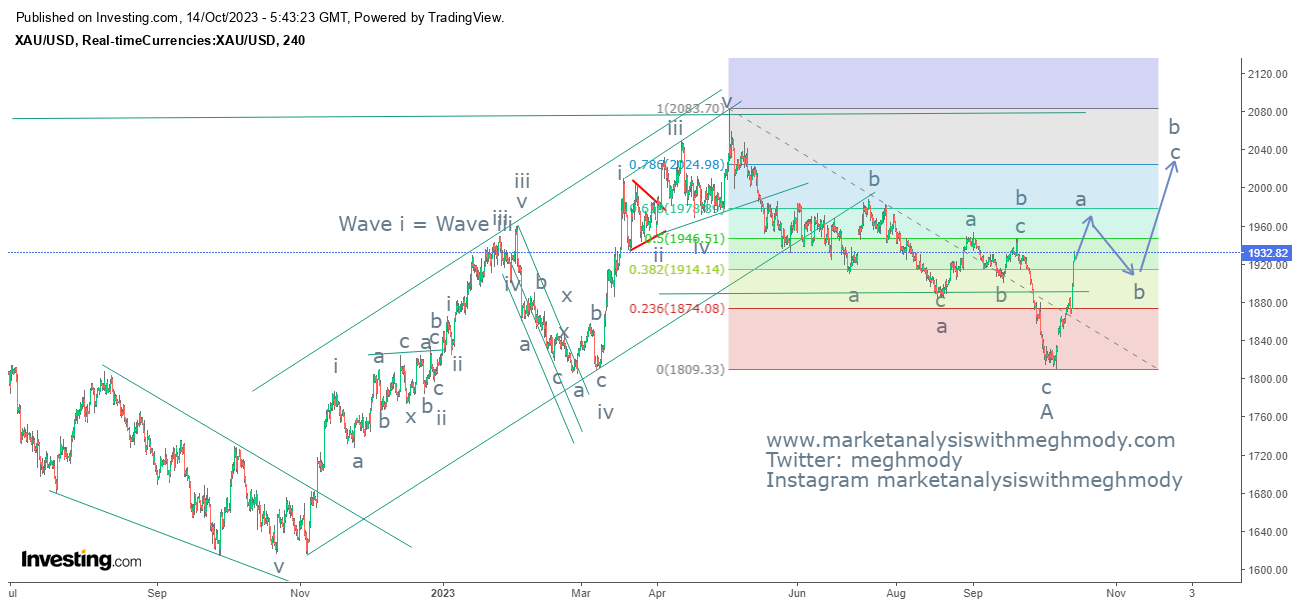

Gold Anticipated Happned

Gold anticipated on 14th Oct 2023 Gold happened on 28th Nov 2023 Analysis In my prior article, I noted that "Gold prices have the potential to climb higher and may reach the $2025-2030 range in the short to medium term." The yellow metal indeed surged towards $2150 levels, surpassing my projected range of $2025-2030 when it was initially trading at $1933 - the anticipated outcome. To read my previous article on Gold, click on the link below https://www.marketanalysiswithmeghmody.com/2023/10/gold-and-elliott-wave-counts.html Presently, prices are following a flat pattern, having completed wave a of wave b, and this wave b is identified as a flat. The next movement could reach a minimum of 80%, translating to $2090 levels, or it might extend to $2150 levels or beyond. Clear-cut indications point towards prices fluctuating within the $2100-2150 range. Currently, prices are recorded at $2053 levels. To sum up, Gold prices display a positive outlook and are expected to fluctuate