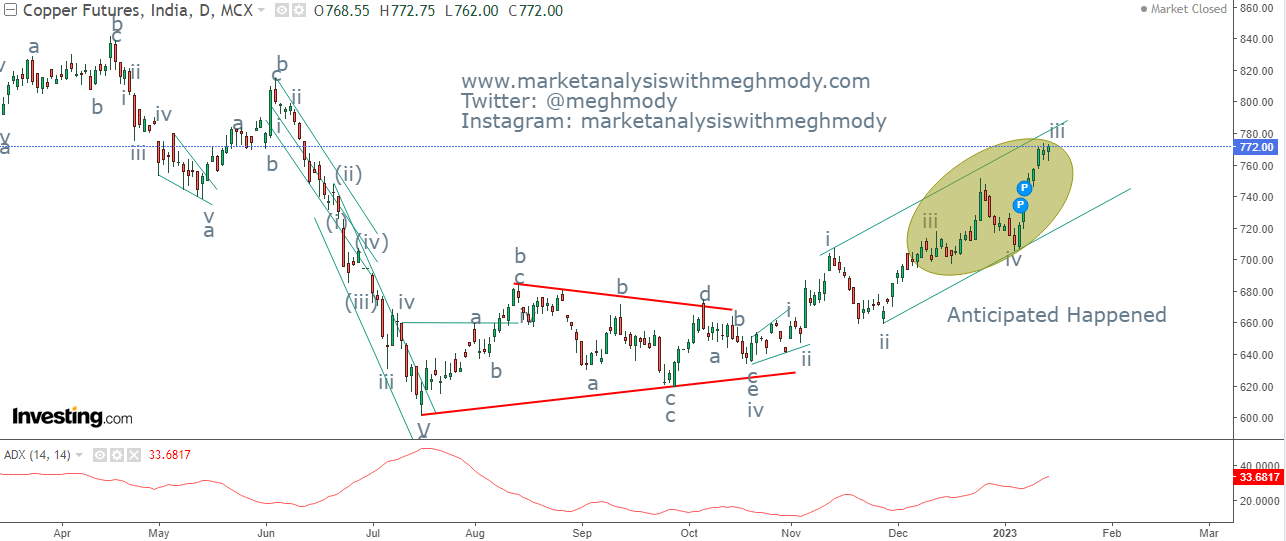

MCX Crude Anticipated Happened

MCX Crude Oil daily continuous anticipated on 17th Dec 2022 MCX Crude Oil daily continuous happened on 26th December 2022 Analysis In my previous article, I had mentioned that, " MCX Crude Oil is all set to move towards 6500-6600 price range before major fall starts." In no time the black gold moved higher and achieved my mentioned level - Anticipated happened To see my previous article on MCX Crude, click on the below mentioned link https://www.marketanalysiswithmeghmody.com/2022/12/mcx-crude-oil-elliott-wave-analysis.html As seen in the above chart, prices are moving in a lower highs and lower lows which is a negative setup. It is also moving precisely in a falling red channel. At current juncture, Crude Oil prices has arrived near to the resistance of the channel. It is imperative to see if prices cross this resistance or continues to falter. Any move above 6800 will give a bullish break in falling channel pattern. If prices break the level of 6200 on the downside then it