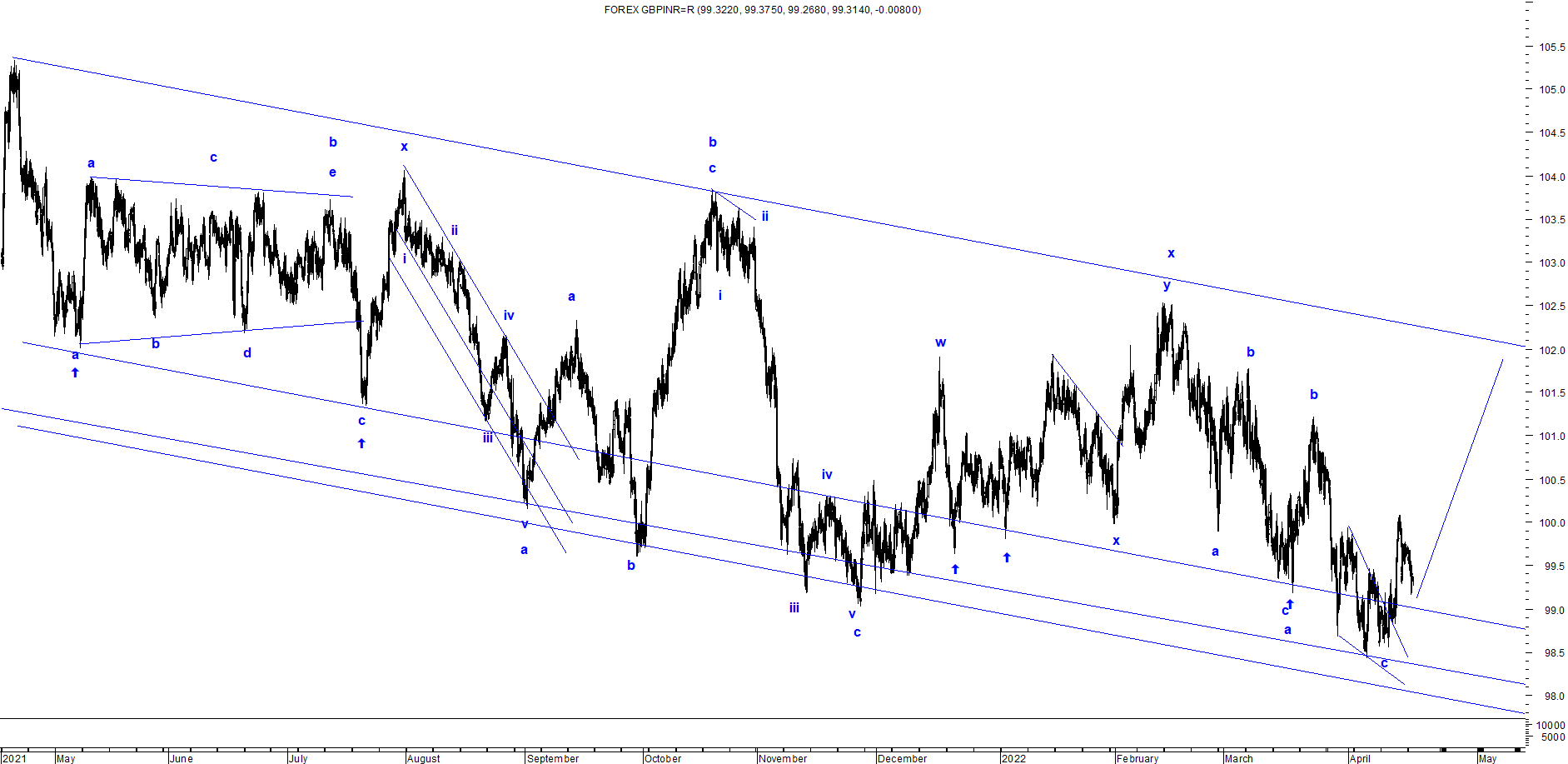

GBPINR: Triple Correction ongoing

GBPINR spot hourly chart In my previous update I had mentioned for GBPINR that, " GBPINR can test 99 levels but will reverse the direction to move back up till 102 levels over medium term." To view my previous article on GBPINR, click on the below link https://www.marketanalysiswithmeghmody.com/2022/03/gbpinr-anticipated-happened.html Prices plunged to 98.5 there by achieving my downside target of 99 but it is now on the brink to reverse as it can test the resistance of the falling channel- Anticipated happened As per Wave analysis, prices are moving in a Triple correction (a-b-c-x-a-b-c-x-a-b-c) where it has completed wave a of the third correction and it is all set to start wave b on the higher side which can move back up till 101.7-102 levels. The summation is GBPINR is set to bounce from the support of the channel and can test 101.7-102 levels over short period of time.