USDINR: Tumbling near its previous lows?

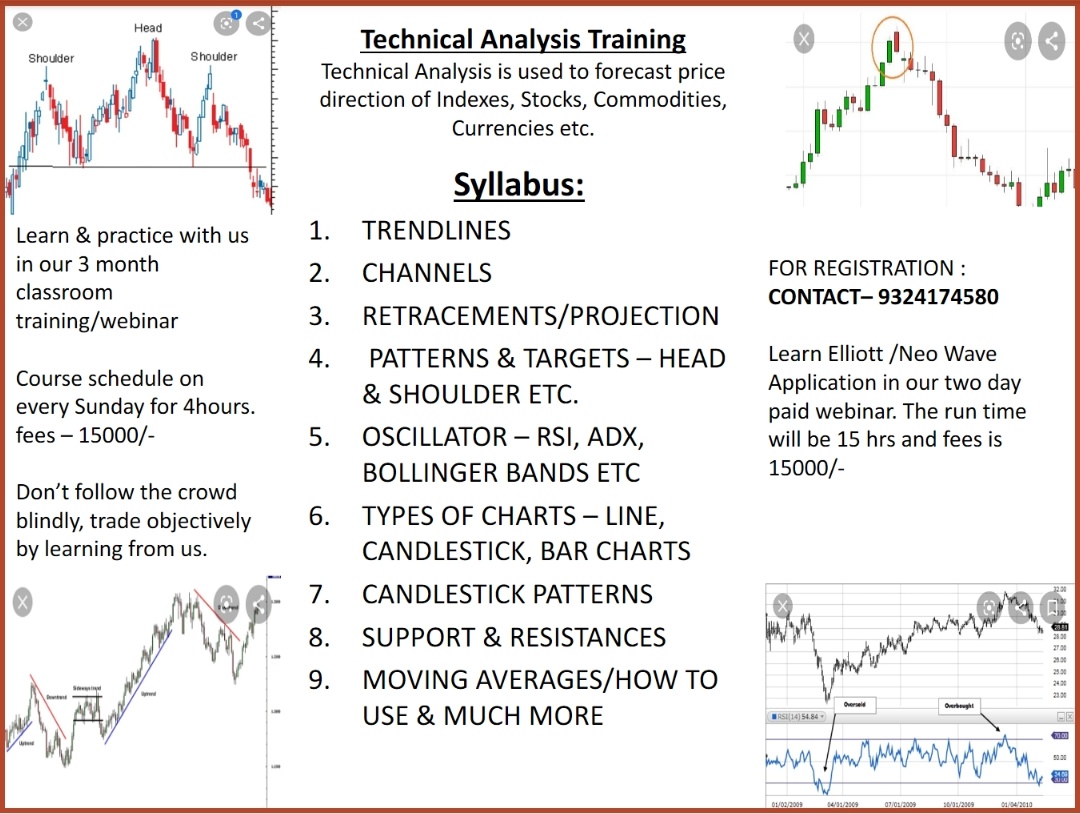

USDINR 60 mins chart As per Elliott Wave analysis, prices are moving in wave c which can tumble till 70.60-70.4 levels in near term. Th preceding trend was a three wave structure (a-b-c) which was wave b and earlier to that a complex correction (w-x-y) which was wave a. However, I have only one concern that wave b has only retraced 61.8% of the previous fall, so it cannot be a flat pattern though wave a and wave b was a three wave structure. So the summation is the entire fall will be wave a as it can retrace 50% of the rise from 68.4 o 72.6. The bias is negative as of now for this pair. Learn Elliott Wave and Neo wav in my two day paid webinar The run time will be 12-15 hrs and the fees will be Rs. 15000/-. Classroom training is also provided. For registration call 9324174580.