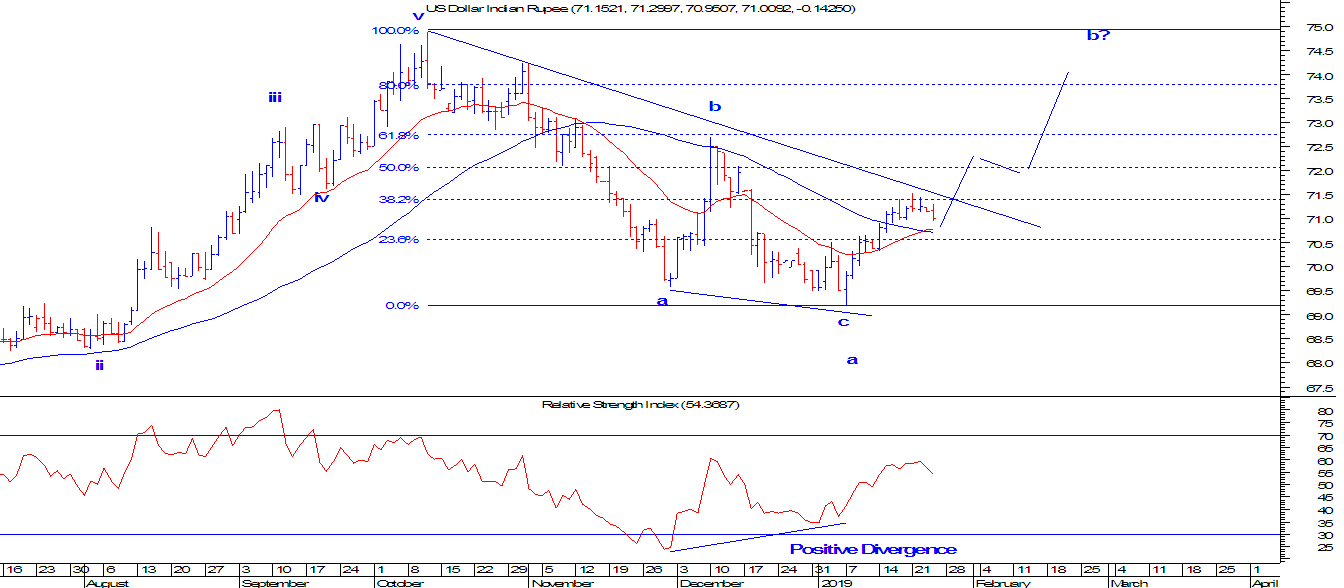

MCX Copper: What happens after impulse wave?

MCX Copper 60 mins chart MCX Copper in hourly chart is hovering near to the resistance of the rising channel. This opens the possibility that prices can correct from current levels which can drag prices lower till support of the channel. From wave perspective, prices are moving in an impulse fashion (i-ii-iii-iv-v). It seems it has completed wave v and it is set to move down in wave a of one higher degree. In short, MCX Copper is expected to tumble in-between 455-453 levels over short term with resistance placed at .... It is not difficult to predict the market by using advance technical analysis, but it is difficult to understand advance technical analysis. If I can do it, you can also do it. All you need to do is mail me at meghmody@gmail.com and subscribe to my two day paid seminar. In these two days you will learn the concept of Elliott Wave and Neo wave, combination of price and time, how to anticipate, tools required to anticipate the rise and fall of price.