MCX Copper: Corrective mode

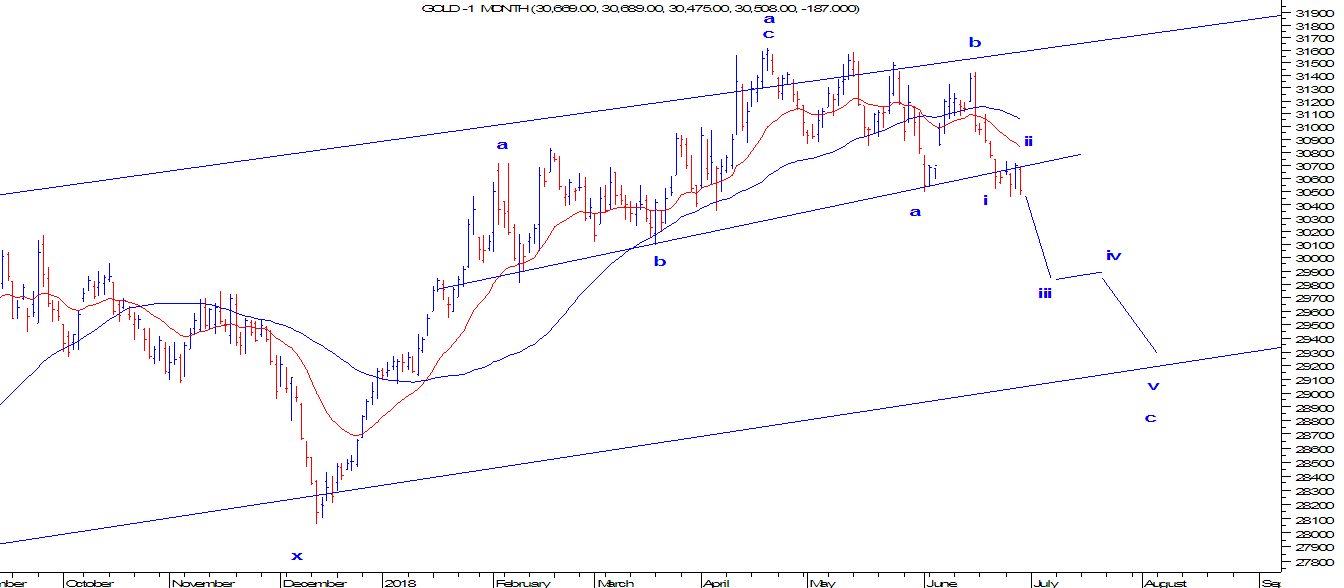

MCX Copper Daily Continuous MCX Copper has started to plunge once it discontinued the higher high and higher low formation which eventually broke the rising channel as well. Prices recently made a low of 402 and turned its direction up till 434 levels. Interestingly, the up move was very slow and the weekly candle has formed a bearish candle. This indicates, that prices will fail to cross 439 levels and will turn down in coming week. As per wave theory, the red metal has formed a counter trend after the fall from the high of 493 to 402. Now after completing wave i and wave ii on the downside, I am expecting prices will plummet near till 395-390 levels in form of wave iii. In short, the bias is firmly negative for Copper as it is expected to test 395-390 levels in near to medium term. Learn Elliott Wave and Neo Wave to forecast prices in various asset classes. Subscribe to a two day paid online webinar which will help you to learn in dept analysis of price along with t