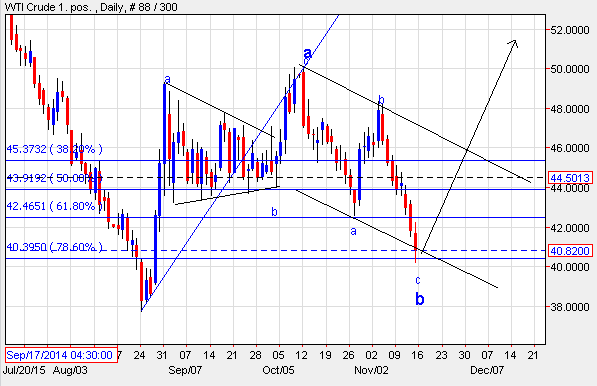

WTI Crude to test $53 levels (Elliott Wave Analysis)

In my previous update " WTI Crude to surge going ahead", I had mentioned that " E xpect prices to move down for short term at $44 per barrel followed by resumption of an uptrend which can push prices higher near till $53 per barrel". WTI made a high of $48 before sinking to $40 on 13th November 2015. It tumbled to more than 8% on weekly basis. However, the bias continues to be positive as prices are moving in a sideways direction after surging from the bottom of $37 per barrel. As per wave theory, from the bottom of $37.75 till $49.32 the wave structure was an impulse. At $49.32 wave a was completed followed by wave b which completed five waves in a triangle pattern and then wave c again in an impulse pattern. The following wave is wave x or wave b (if I mark the prior three waves as wave a on a higher degree) as it is coming down in a three wave structure. It has also retraced near to 80% of the previous rise indicating flat structure. In short, th...