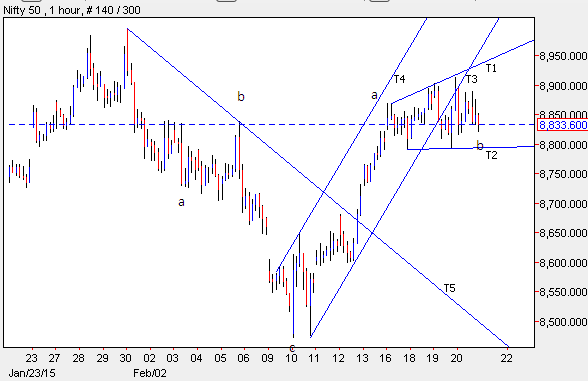

German DAX heading for 13000? (Elliott Wave Forecasting)

European Markets are at their historic highs and can surge further in near term as well. Germany which is the largest economy of Euro zone is quoting at 12300 levels. The recent lift in European indices was due to ECB who started their massive stimulus package to uplift the economy from the clouds of deflation. As per Elliott Wave principle, prices are moving in a positive direction as a corrective pattern (a-b-c). Currently it is moving in a wave c pattern which is an impluse pattern. In an impluse pattern is more aggressive on either side and has five wave in it. Not so soon it has completed wave (iv) on the downside and it is moving higher in the form of wave (v) of wave c which can test 13000 mark. In short as far as the level of 11800 is protected on downside the bias for German DAX is positive with the possibility for the levels of 13000. DAX daily chart