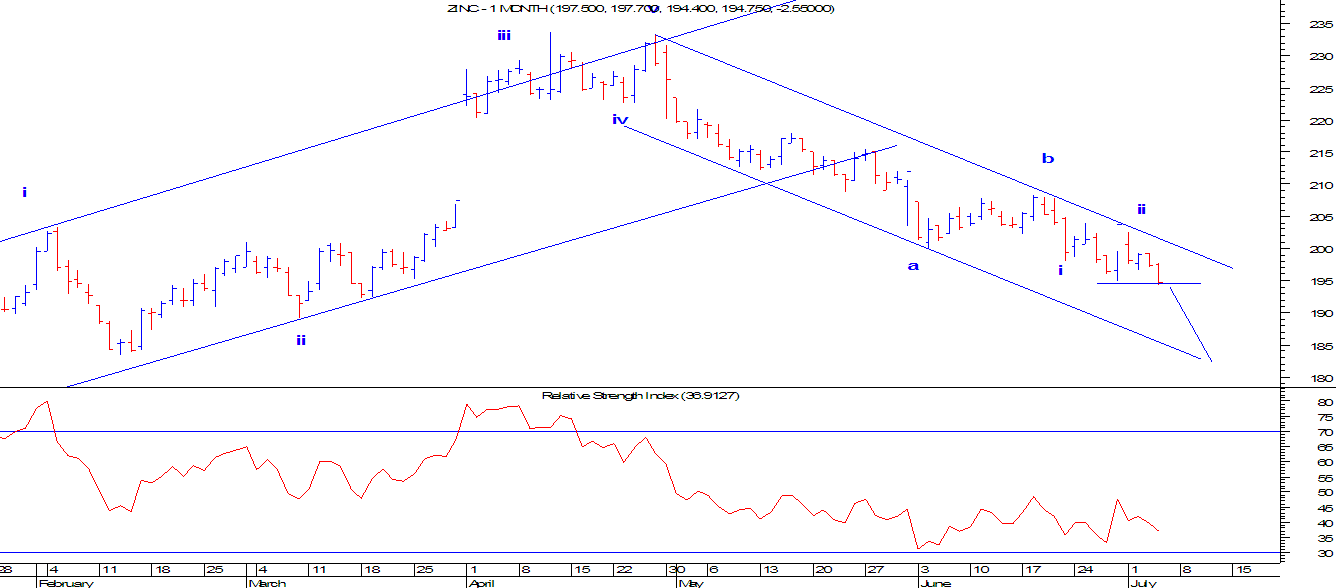

MCX Zinc: Corrective pattern to unfold- Happened

MCX Zinc Daily chart Anticipated on 7th July 2019

In my previous update on MCX Zinc I had mentioned that, "Zinc is moving precisely in a falling blue channel. Prices recently faced the resistance of the channel and reversed. It is also on the brink to break its previous low (marked by blue horizontal line). Any break below 194 will open further negative possibilities which can drag prices way lower, near o the support of the channel.

Full article here

https://www.marketanalysiswithmeghmody.com/2019/07/mcx-zinc-corrective-pattern-to-unfold.html

MCX Zinc Happened on 8th August 2019

In my previous update on MCX Zinc I had mentioned that, "Zinc is moving precisely in a falling blue channel. Prices recently faced the resistance of the channel and reversed. It is also on the brink to break its previous low (marked by blue horizontal line). Any break below 194 will open further negative possibilities which can drag prices way lower, near o the support of the channel.

Full article here

https://www.marketanalysiswithmeghmody.com/2019/07/mcx-zinc-corrective-pattern-to-unfold.html

From wave perspective, prices are currently moving in wave c which seems to be elongated. This means that the subdivision of the waves within wave iii are equivalent to one higher degree. Currently prices are in wave iii in which it has completed wave iii. A pull back can take prices higher till 185-187 levels in the form of wave iv of wave iii.

In short, a relief rally is expected in MCX Zinc which can take prices higher till 185-187 levels in near term.

In short, a relief rally is expected in MCX Zinc which can take prices higher till 185-187 levels in near term.

Comments

Novateor Research Laboratories Ltd IPO