Bitcoin Revisited Part II

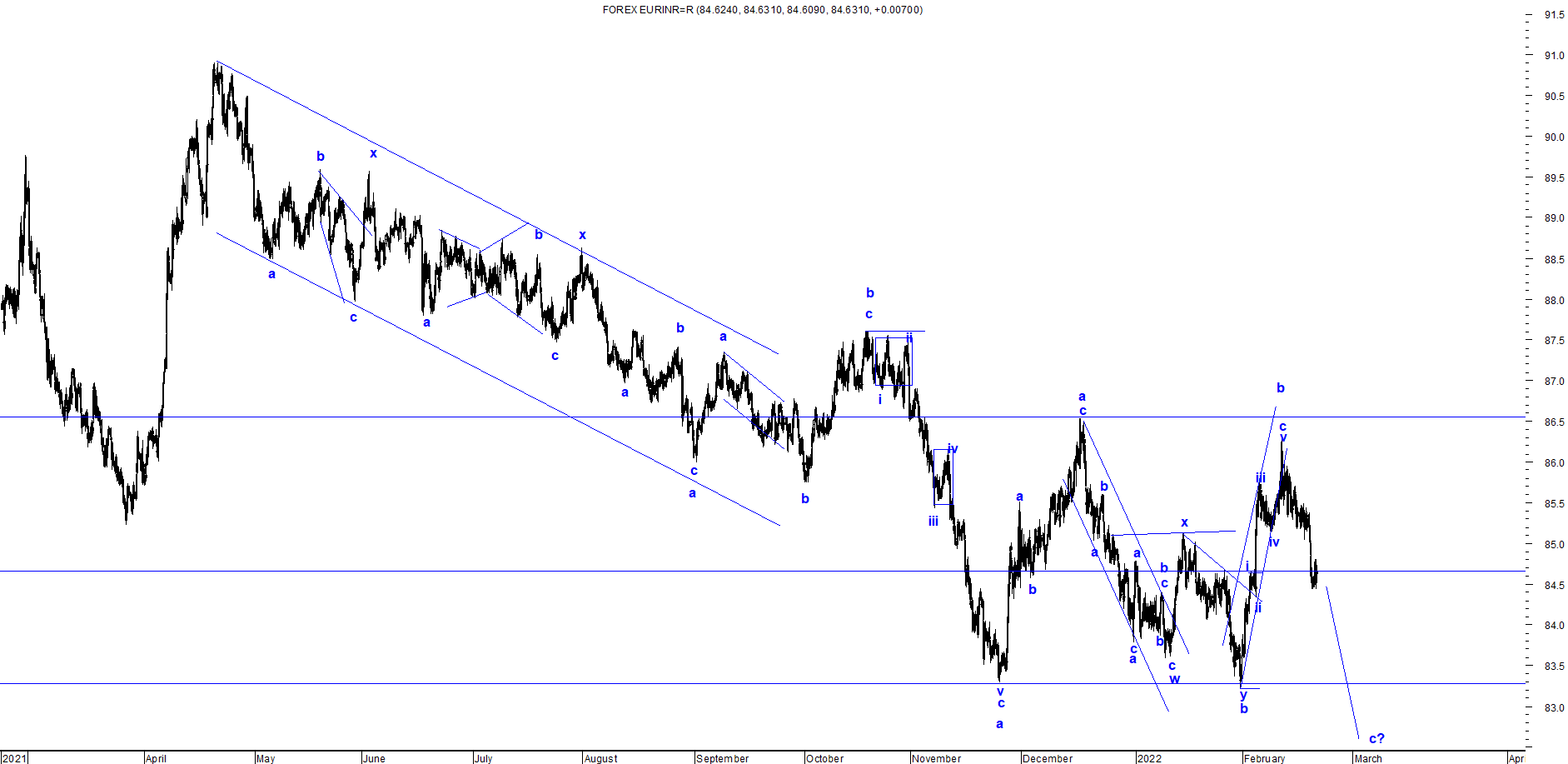

Bitcoin daily chart As shown in the daily chart, BTC has been moving as per my analysis. I must tell all my readers that from the month of January 2022, I am in a view that Bitcoin will test $75000 this year (2022). To add, last year in the month of July 2021, I had predicted the reversal in this crypto and was successful. This year am expecting reversal. I have written many BTC articles, click on the link to see view the articles Bitcoin Elliott Wave Analysis https://www.marketanalysiswithmeghmody.com/2022/01/bitcoin-elliott-wave-analysis.html Bitcoin Revisited https://www.marketanalysiswithmeghmody.com/2022/01/bitcoin-revisited.html Bitcoin Elliott Wave and Neo Wave Analysis https://www.marketanalysiswithmeghmody.com/2021/08/bitcoin-elliott-wave-and-neo-wave.html As per Elliott Wave, I think wave y is finally over in the form of triangle. This completion has already opened the possibility of moving prices to a new high and to my above mentioned target. The summation is BTC is very p