USDINR: Anticipated Happened

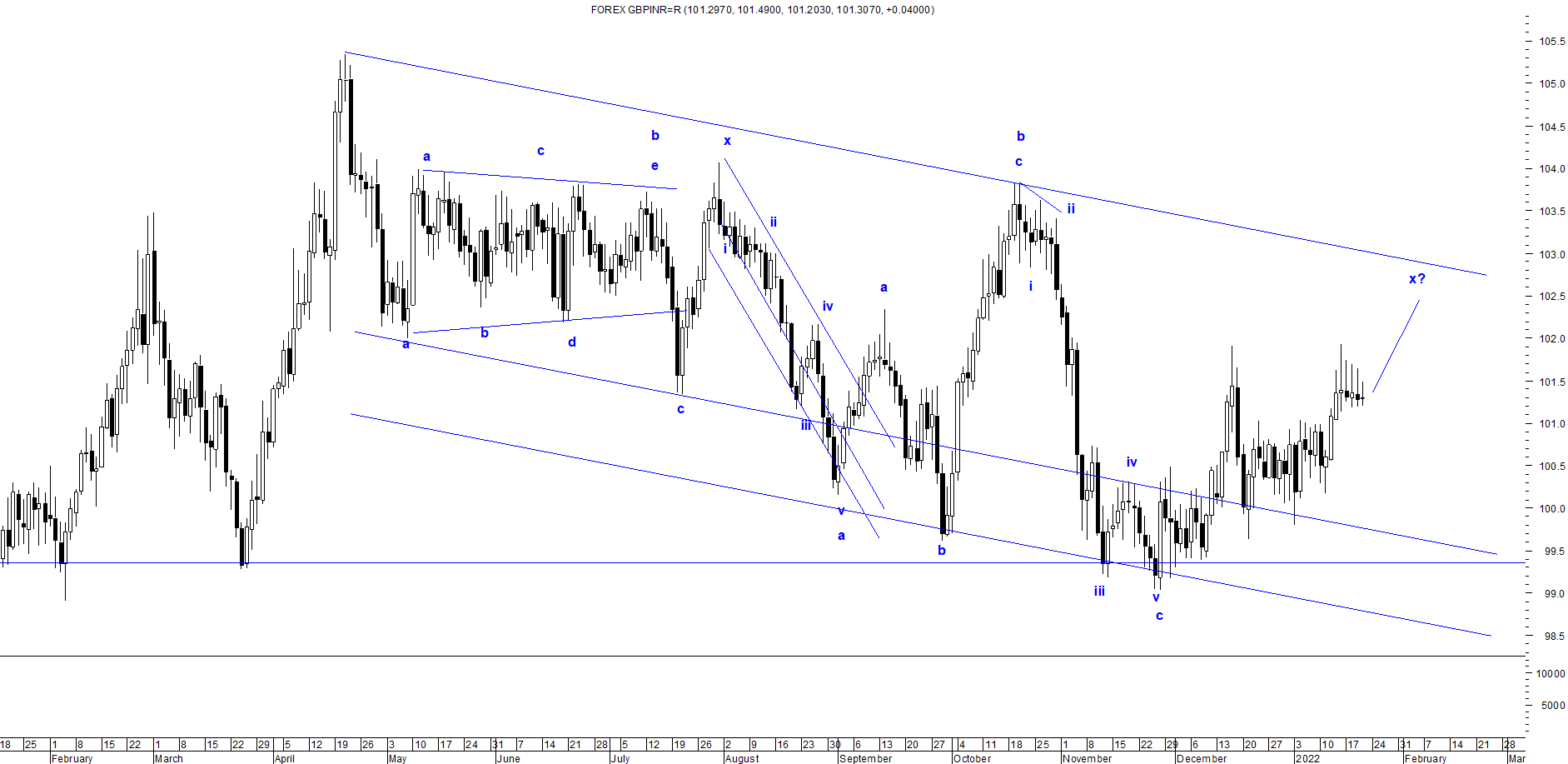

USDINR 60 mins spot chart anticipated on 24th Jan 2022 USDINR 60 mins sport chart happened on 15th Feb 2022 In my previous update of USDINR, I had mentioned, " USDINR is firmly positive and can move near till 75.6-75.7 levels once the level of 74.7 is decisively crossed and sustained." Prices achieved the above mentioned level of 75.7 (spot) on 15th Feb 2022 and reversed from there - Anticipated Happened. To read my previous article on USDINR: Inverse Head and Shoulder Pattern click on the below link https://www.marketanalysiswithmeghmody.com/2022/01/usdinr-inverse-head-and-shoulder.html Currently prices are moving in complex correction which is (a-b-c-x-a-b-c) this can be wxy eventually or can be simple a-b-c and the current fall is wave x. In both the scenarios, prices will continue to surge and possibility is high it can transcend its ATH.