GBPINR: Anticipated happened

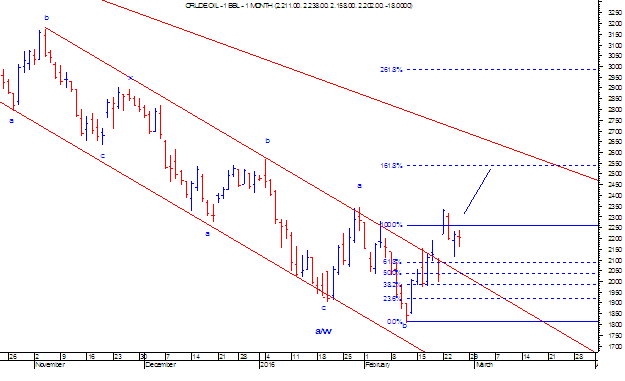

This excerpt is taken from our daily publication "The Forex Waves" dated 8th March 2016 , In which we had mentioned that “ resilience can be observed in this pair which can take prices near till 96.60 levels over short term.” The pair on 11 th March 2016 made a high of 96.61 thus achieving our above mentioned level. GBPINR which is negatively poised is currently showing some strength in order to relieve from the oversold zone. It can possibly reach near to the resistance of the falling black channel which is placed at ... levels. As per Wave theory, prices are moving in a .... pattern. The current up move is slow which can be termed as wave .., also it is corrective in nature. This leg can extend going ahead as it is clear that wave ... of wave ... has open up. In short, we will continue to be .... in this pair as it can move near to ... levels. GBPINR Anticipated on 8th March 2016 Happened on 11th March 2016