Bharti Airtel: Anticipated Happened

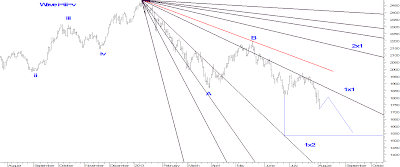

Yesterday we had published an article on Bharti Airtel by saying that its last leg on upside is over and has started next move on down side which can move down till 300. We were very accurate in capturing this move as Bharti Airtel today made a low of 301 in the first hour of trade. Daily Chart of Bharti Airtel on 19 th August 2013 Daily Chart Bharti Airtel Anticipated Happened on 20 th August 2013 Note: Daily chart not updated on 20 th August 2013 We had mentioned in our previous article, that the stock has broken many supports and has completed a distribution pattern on smaller time frame which can lead prices lower till 300 levels.