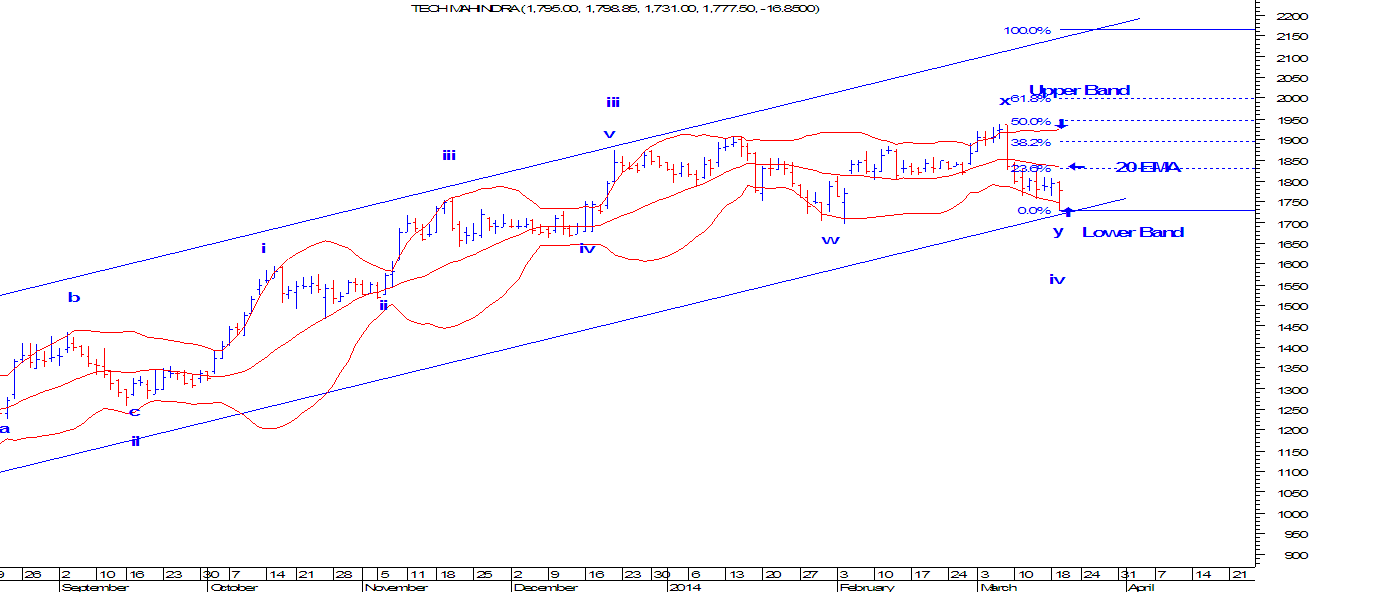

Tech Mahindra: Bollinger Bands and Elliott Wave Counts.

Tech Mahindra, on June 25, 2013 announced the completion of Mahindra Satyam’s

merger with itself. Post-merger, the new entity becomes the fifth largest IT Company

in the country with revenues of $2.7 billion. Combined

entity has a team of 83,000 professionals, servicing 540 customers across 49

countries. It has 15 overseas offices for BPO (business process outsourcing)

operations and software development. Its revenue for 2012-13 was put at $2.7

billion (Rs. 16,000 crore).

Technically,

it is very clear from the below daily chart that the stock is moving up by

forming a higher highs and higher lows and it is moving in an upward sloping

blue channel which is a healthy sign for this IT stock. On 19th

March 2014, the stock was down but it bounced lately which clearly suggests

that there was a buying seen.

Using

Bollinger Bands has always helped to understand the range of the asset class.

These are self adjusting bands and are very helpful in a range bound market. In

this stock, prices bounced from the lower band and is now moving up to its

median i.e. 20 EMA. It can also move till its upper band which is somewhere

near 1950 levels. This indicator helps traders to buy near the support and sell

at the resistance or vice-versa.

From

wave perspective, prices are moving up in an impulse fashion. This means that

it has 5 legs on upside. Recently, we think that it has completed wave iv at

1731 and it is now moving up in the form of wave v which is the last leg. The

stock can move till 2000-2050 levels over short term.

In

short, our bias for Tech Mahindra is

firmly positive as it can move till 2000-2050 levels which is 61.8% projection

of wave i.

Comments