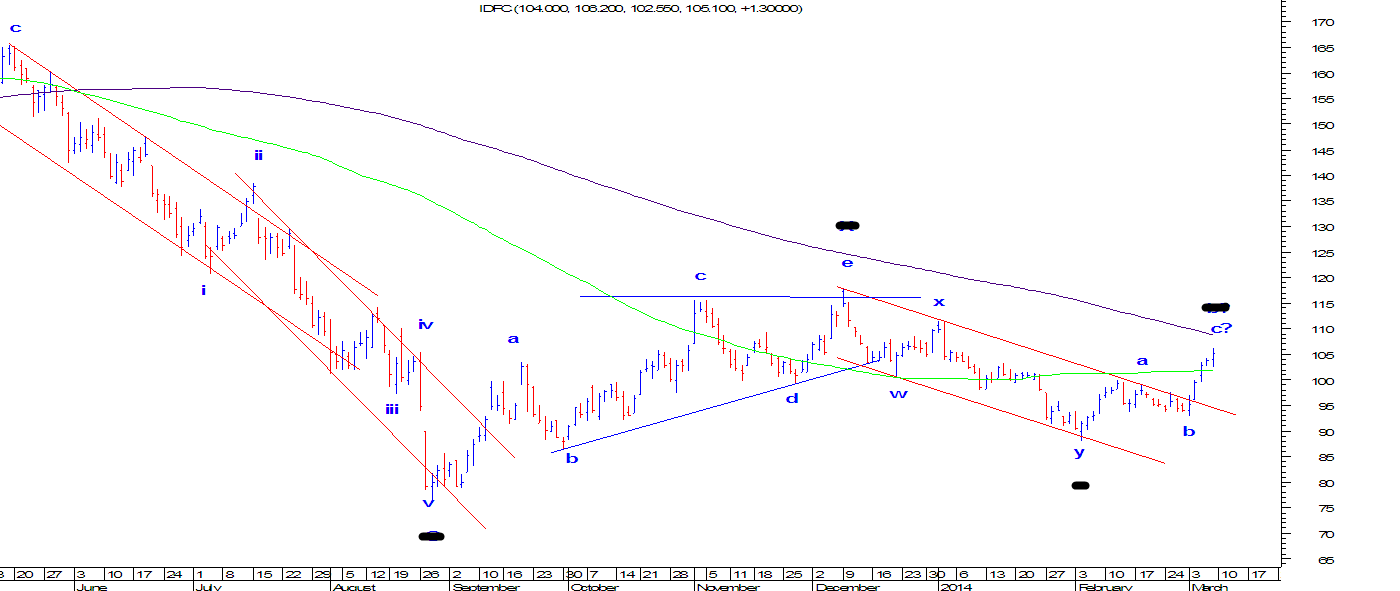

IDFC: Elliott Wave Counts or Banking License Assurance?

IDFC is been in news

in Dalal Street from some time especially when there was an outbreak that IDFC

has more chances to get the banking license then the other candidates. Many

analysts, brokers, investors and traders are very bullish for this stock. Does

news really drive the stock prices?

To know the answer we

used Elliott Wave analysis to get the objective answer. This advance technical analysis

is very useful tool to take proper trading decisions and helps to initiate

trade with proper risk/ reward ratio.

From the below daily

chart we can observe that prices has given a bullish break in the falling red

channel which has pushed prices higher till 106 after giving break on 4th

March 2014. Is this breakout going to sustain? Or it will start its down move?

We have used Elliott

Wave which says that one more leg on the downside is still pending which can

come very soon before the up move starts. The reason is after making a high of

117 in the month of December 2013 prices came down in a corrective fashion and

then it started moving up in the same manner which clearly suggests the stock

is moving in complex correction. The current up move is also a part of a

corrective wave. Using simple technical tools along with Elliott wave can also help

in finding the resistance and the support for a particular asset class. We have

used moving average concept to find out the resistance of the current corrective

move. 200 day moving average (purple) has been a resistance for this stock and

it has arrived near it. Historically from past 9 months prices have not moved

above this moving average.

In short, be

cautiously positive for IDFC as it can start moving down very soon which will

complete one higher degree wave and may start its next up move soon. For

investors and trader it is better to buy on dips

Comments