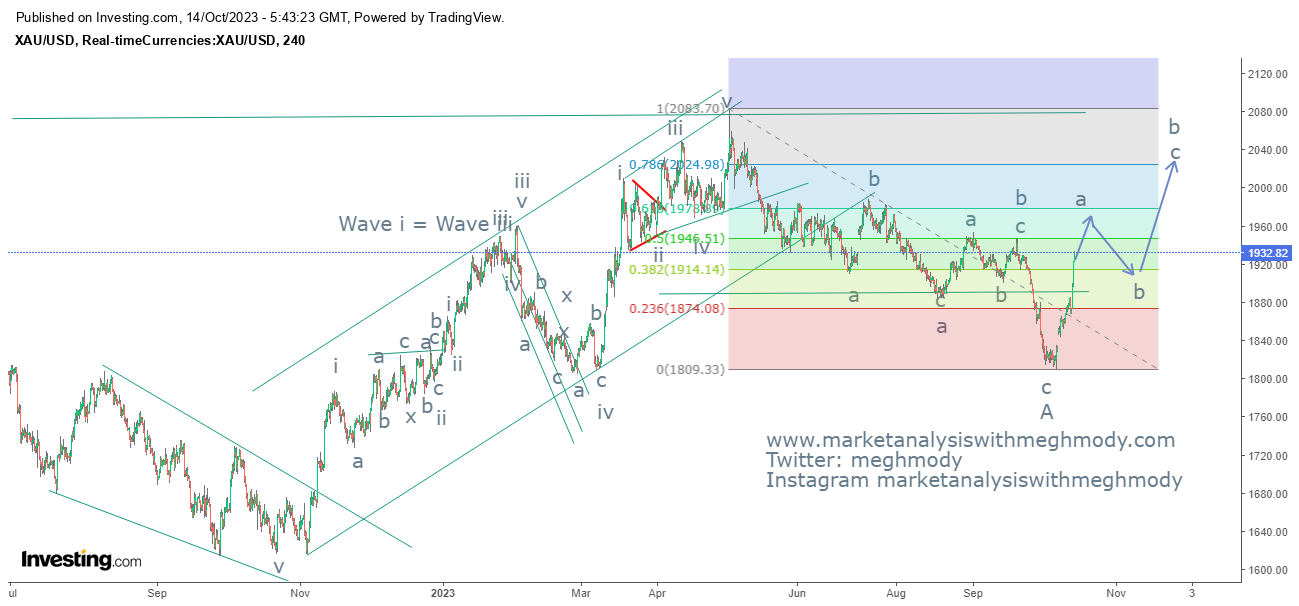

GOLD and Elliott Wave Counts

Gold 4 hour chart Analysis As seen in the above chart, gold prices shot up after escalating geopolitical concerns. Gold prices are moving higher after making a low of $1800 levels and yesterday it closed well above $1930 levels and it is on the brink to cross its previous swing high, which will indicate that the trend is firmly positive. According to Wave theory, prices completed wave a at $1809 levels and has started moving higher in wave b which is also a corrective structure thereby forming a flat pattern, prices can move towards 80% (minimum) which comes to $2025-2030 levels and maximum it can go till 123.6%-138.2%. The summation is Gold prices can move higher going ahead and can test the level of $2025-2030 levels over short to medium term. Join my Telegram Channel : https://t.me/elliottician1 Join My Twitter handle : https://twitter.com/meghmody? s=11&t=LtKvFYlMyQs71k-udwEPgQ