Tata Power Elliott Wave Analysis

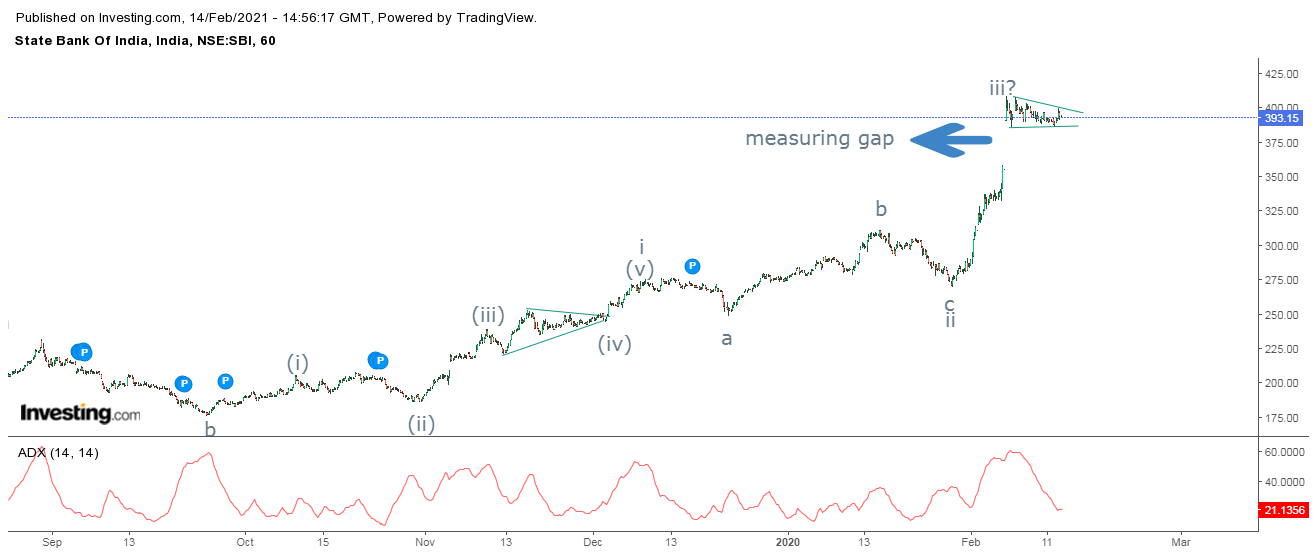

Tata Power daily chart Tata Power hourly chart As shown in the daily chart, Tata Power is moving up by crossing its previous high. To embellish, the angle of the rising channel are becoming steeper and steeper which gives an indication that the trend is becoming stronger. From hourly chart, the stock is has given a bullish break in a symmetrical triangle pattern and can move higher from current levels. However, it has arrived to the resistance of the channel, from where it has reversed several times. There are chances it might go sideways to negative but will make a new high before reversing. From Waves perspective, wave i and wave iii are equal, at present it is moving in wave v in which it is extended. Wave iii of wave v is extended and so it has either completed wave iii of wave v and wave iv lower will start followed by wave v of wave v higher. The second scenario will be wave v to extend which looks least likely, but still open. The summation is Tata Power is firmly positiv