Nifty to test 7960 levels (Elliott Wave Analysis)

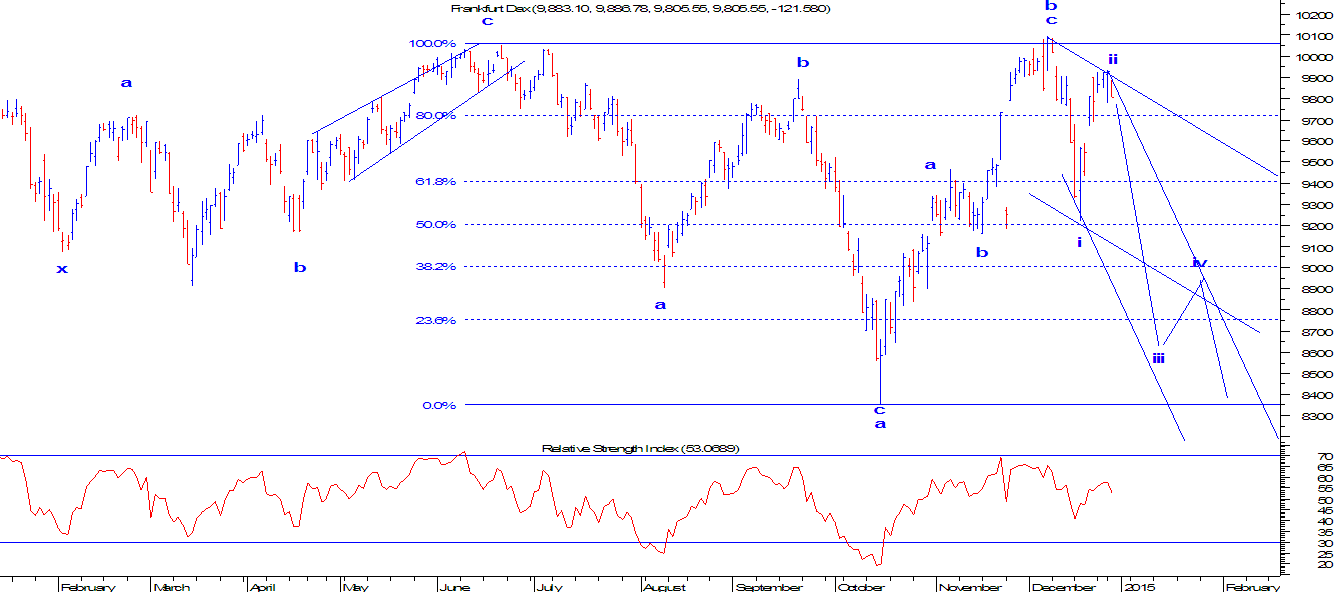

Nifty made life time high of 8627 levels in the month of December 2014 and thereafter it moved down till 7960 levels, thus eroding 7.73% from the highs. The index then gave a technical bounce and retraced 80% of the previous down move making a lower high at 8445 levels. Today the index snapped 6 day rally and thus gave a reversal bar at the top. A gap down move on the following day will open negative possibilities which can drag prices lower till its previous bottom. RSI has also bounced from the level of 30 and can now resume its down trend. According to wave theory, after marking a high of 8627 levels, prices came down in a corrective pattern and completed wave a, followed by 3 wave structure and completed wave b. Now there is one more leg on the downside which is wave c. According to the projection, wave c can move down till 61.8%n of wave a &b which comes to 8050 levels, breach of this level will then force prices to test the pivot low of 7960 levels. In short, Nifty is i