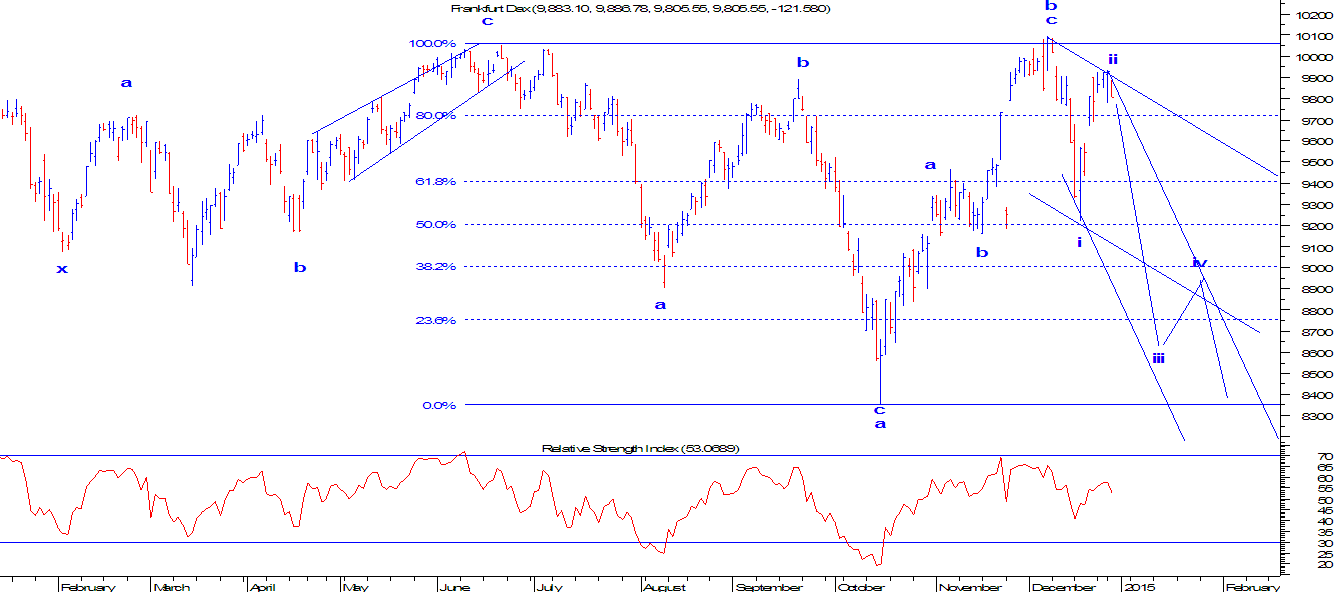

DAX (Germany): In wave c (impulsive)

From the daily chart, DAX is moving in a lower high and a lower low formation and precisely in a down ward sloping channel. This is a negative formation and can make this index slip down to lower levels. Momentum indicator RSI has also reversed from the level of 70 (overbought) and will now test the level of 30 over can even go lower. As per wave theory, the index is moving in an irregular flat pattern (a-b-c), is now moving in a last leg of this pattern which is wave c. Wave c is impulsive in nature and can also be corrective (ending diagonal). Wave c has 5 legs in it and currently it is moving in wave iii. In an irregular flat pattern prices tend to test the end of wave a or can even go below it. The target of this pattern comes to 8400 levels. In short, German DAX is expected to test the level of 8400 levels in near term and the bias remains firmly negative.