Nifty Bank: Elliott Wave Analysis

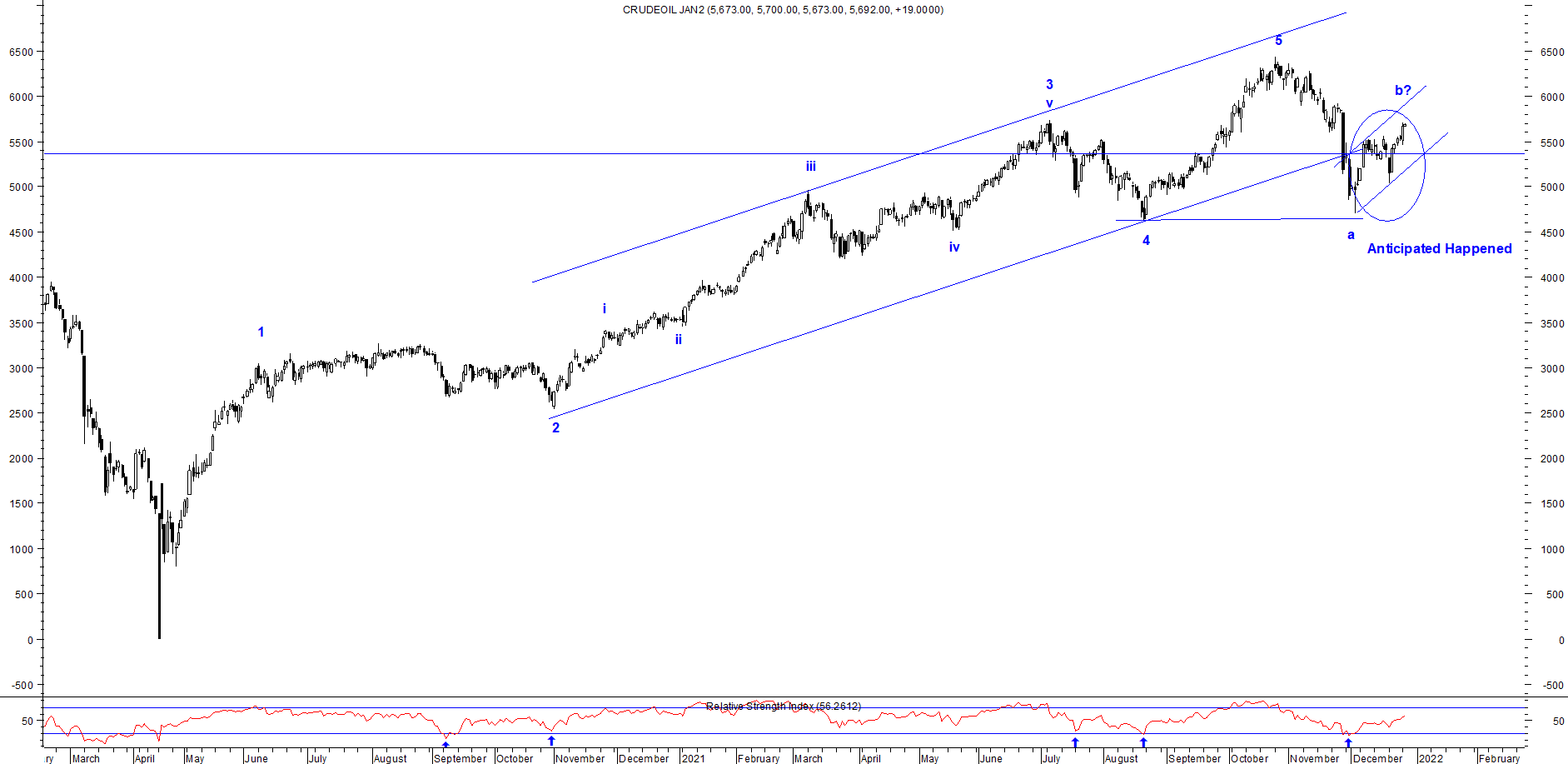

Nifty Bank hourly chart From the above chart, Nifty Bank is moving in a higher highs and higher lows and it is precisely moving in a rising channel which is a positive sign. Recently prices have retraced back to test the support of the channel, any bounce from current levels will open further positive possibilities. As per Wave theory, prices are moving in am impulse fashion, in which it has probably completed wave iv in a flat pattern and it is on the brink to start wave v which can move up near to 39900-40000 levels. The summation is Nifty Bank is all set to move higher over short term near 39900-40000 levels, as far as 37400-37200 is intact on closing basis.