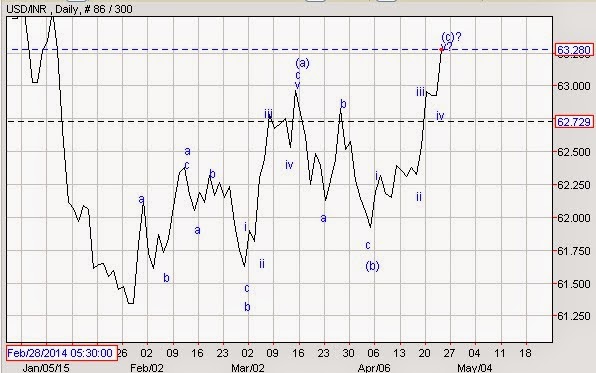

USDINR: Neo Wave Diametric Pattern

From May 2014 USDINR formed a diametric pattern which took seven months to complete. Diametric patterns are of two types Contracting and Expanding. In a diametric pattern there are seven legs (a-b-c-d-e-f-g) which are all corrective in nature. The first diametric in USDINR was expanding diametric, in a layman term, it is been termed as diamond pattern. The probability is much higher that the pair is forming another expanding diametric pattern which commenced from February 2015. Forecasting: The pair is moving in a double correction of diametric pattern, which can be labeled as (a-b-c-d-e-f-g-x-a-b-c-d-e-f-g). The first diametric shown in the chart (box) completed the last leg wave g at 62.20 levels followed by wave x which has three legs within (a-b-c). After completing wave x, the pair resumed its uptrend and plausibly started forming another diametric pattern. As per the wave counts it completed wave d in a three wave structure which is also the longest wave in the diametr